Cryptocurrency Gifts

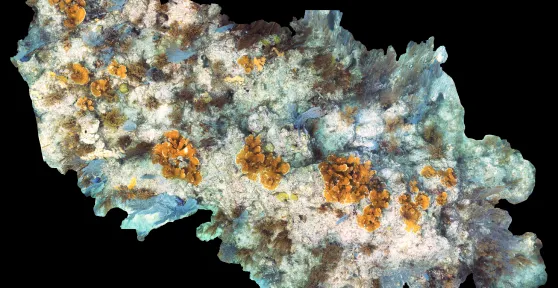

There's nothing cryptic about the benefit of saving coral reefs

Investing in the future of our oceans is easier than ever by donating your cryptocurrency to restore our coral reefs.

The IRS classifies cryptocurrencies as property, so cryptocurrency donations to 501(c)3 charities receive the same tax treatment as stocks.

Donating cryptocurrency is a non-taxable event, meaning you do not owe capital gains tax on the appreciated amount and can deduct it on your taxes. Please contact your tax or financial advisor for more information.

Want to learn more? Check out our donor story!

Read donor storyFAQS

Which cryptocurrencies are accepted?

We are continually in the process of adding support for new cryptocurrencies, so please check back soon for more giving options.

THE CORAL RESTORATION FOUNDATION, INC./CH13455

A COPY OF THE OFFICIAL REGISTRATION AND FINANCIAL INFORMATION MAY BE OBTAINED FROM THE DIVISION OF CONSUMER SERVICES BY CALLING TOLL-FREE (800-435- 7352) WITHIN THE STATE. REGISTRATION DOES NOT IMPLY ENDORSEMENT, APPROVAL, OR RECOMMENDATION BY THE STATE.